Explain the Difference Between a Buyer Assuming the Mortgage

The buyer will have to pay the difference. Explain the difference between a buyer assuming the mortgage and taking title subject to the mortgage.

Getting a Subject To Mortgage.

. Often people refer to a home loan as a mortgage but a mortgage isnt actually a loan agreementIts the promissory note that contains the promise to repay an amount borrowed to buy a home. However under a creditworthiness assumption process the buyer must first pass the standard qualifications set by the dispensing lender. In contrast mortgage pre-approval is the most comprehensive step a buyer can take toward attaining a home mortgage.

A simple assumption mortgage is a private transaction between a home seller and homebuyer. Explain the difference between a buyer assuming the mortgage and taking title subject to the mortgage. Potential VA Loan Assumption Challenges.

If the purchaser acquires the property subject to the existing debt he does not acquire any personal liability for the debt. Another advantage to the Buyer is that the Buyer will pay off the house faster because heshe is already a number of years into the existing mortgage. The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility.

To get pre-approved for a mortgage the buyer will submit an official mortgage application and document their financial history for their lender. The seller uses the proceeds of the sale to repay their loan in full shifting the financial obligation for the property solely to the new owner. A prepackaged bankruptcy Question 2-14 Explain the difference between a buyer assuming the mortgage and taking title subject to the mortgage.

Explain the difference between a buyer assuming the mortgage and taking title subject to the mortgage. In the 1970s and 1980s assumable mortgages were quite popular because many. Updated on May 02 2019.

A property that is subject to a mortgage is a. Assumable Mortgages Are Few and Far Between. FHA loans are assumable.

When a buyer assumes a loan it is with the lenders knowledge and approval. Once the lender verifies the information they will offer a pre-approval letter to the buyer stating that. You must be employed and have an income history of at least two years.

In a typical purchase transaction the buyer is getting a mortgage loan to purchase the home. When it is said that the purchasers taking title subject to. The buyer takes the title to the home and assumes responsibility for the sellers mortgage payments.

A purchase-money mortgage can be used in situations where the buyer is assuming the sellers mortgage and the difference between the balance on the assumed mortgage and the sales price of the. Some states use mortgages to create the lien while others use deeds of trust or another. Explain the difference between a buyer assuming the mortgage and taking title subject to the mortgage.

Assumed mortgages on the other hand delegate liability. In other words when a borrower fails to repay a non-recourse loan. Explain the difference between a buyer assuming the mortgage and taking title subject to the A.

Its not right for everyone but it could make closing on a home shorter than a TikTok jk. Thats because youre assuming the liability for the mortgage from the previous borrower. An accounting term that sometimes refers to the cost of absorbing losses on defaulted non-recourse debt.

Your email address will not be published. A mortgage assumption proceeds depending on the type of assumption in action. The interest rate stays the same.

Following this payment you will continue paying annual Mortgage Insurance Premiums MIP for the life of the loan. What Is the Difference Between Assuming a Mortgage and Taking the Property Subject to a Mortgage. The lender usually requires a credit history from the.

A loan assumption will always require the approval of the lender. Assuming an existing mortgage when buying a home is quite different from buying subject to an existing mortgage. Borrowers must have a debt-to-income ratio of less than 45.

Leave a Reply Cancel reply. An assumable mortgage is a home loan that can be transferred from the original borrower to the subsequent homeowner. An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process.

Mortgage assumption gives sellers an edge while saving buyers on interest and closing costs. What Are The Dollars And Cents Differences Between FHA And Conventional 97. Also the Buyer assumes the mortgage at the Sellers existing interest rate.

If the purchaser acquires the property subject to the existing debt he does not acquire any personal liability for the debt. Not unlike a traditional loan buyers will assume the mortgage given to them by the lender. This leaves one to wonder with these advantages why do we not see more Buyers assuming mortgages.

No credit check nor lender approval is required. This arrangement may not involve loan underwriting. There are two primary types of mortgage assumption.

Many loans today are not assumable. A mortgage is a contract between you and the lender that creates a lien on the property. If the purchaser acquires the property subject to the existing debt he does not acquire any personal liability for the debt.

The home buying process can be long and challenging but an assumable mortgage could make things faster and easier for both the buyer and the seller. In a simple assumption the lender is not usually involved. Simple assumption and novation.

As the name suggests the seller in an assumed deal is no longer primarily liable. If a buyer follows through with an acquisition and assumes the mortgage they are then liable for the debt.

What Do You Need To Apply For A Loan Real Estate Info Guide Apply For A Loan Loan Home Buying

What Is Private Mortgage Insurance Pmi Private Mortgage Insurance Mortgage Payment Mortgage

Good Read For Home Buyers Buying A Home The Cost Is More Important Than The Price Interest Rates Low Interest Rate Real Estate Tips

Porting Assuming Or Breaking A Mortgage What You Need To Know

Getting Title Insurance Is One Of The Standard Steps Home Buyers Take Before Closing On A Home Purchase Title Insurance Insurance Title

What Is A Home Equity Loan Real Estate Info Guide Home Equity Home Equity Loan Line Of Credit

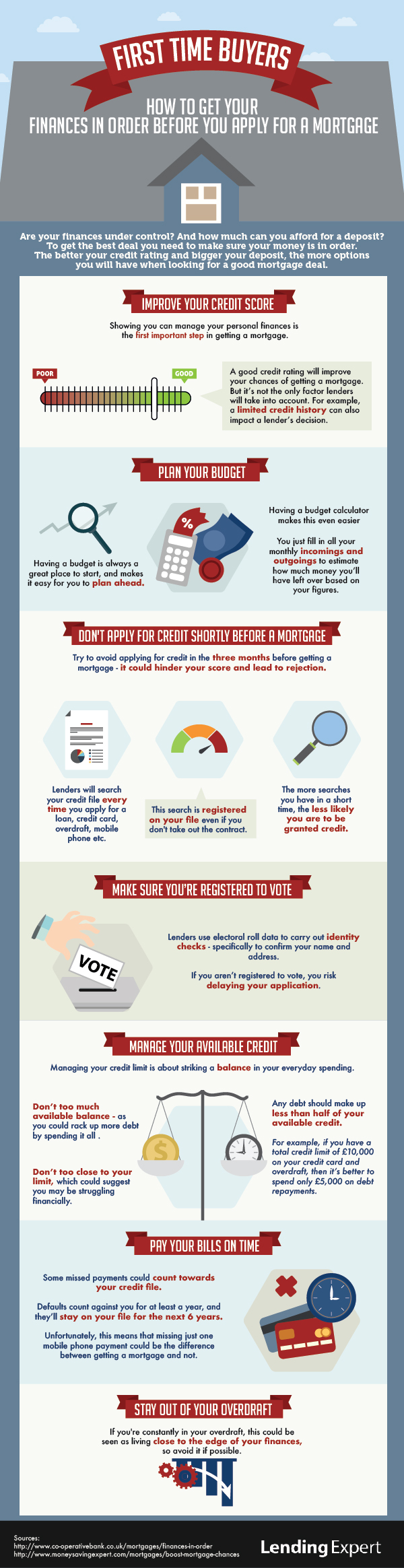

A Guide To First Time Buyer Mortgages Lending Expert

Pin By Elisabeth Hartig Lentulo On My Business Home Ownership Millionaire Mindset Selling House

What Do I Need To Be A First Time Home Buyer Online 58 Off Www Hcb Cat

New Cheat Sheet On Types Of Mortgages Enjoy Real Estate Infographic Mortgage Cheat Sheets

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

How To Increase A Credit Score In Order To Get The Best Rates On Mortgages And Other Loans Http Www Credit Score What Is Credit Score Loans For Bad Credit

The Effect Of Interest Rates On Home Loans Interestrates Homebuyers Morgenrealestate Interest Rates Real Estate Information Mortgage Interest Rates

Several Useful First Time Home Buyer Options And Resources Fha Loans First Time Home Buyers Refinance Mortgage

Getting A Home Loan Paying Cash Or Finance The House Buying Guide Home Loans House Buying Guide Home Buying

Pin On Real Estate News Tips Advice

Mortgages For First Time Buyers Just Mortgage Brokers

Foreclosure Home Remodeling Cuisine Real Estate Tips Real Estate Buying First Home

While Securing A Home Loan Can Seem Overwhelming There Are A Few Things You Can Do And A Few Things You Home Buying Process Mortgage Process Real Estate Tips

Comments

Post a Comment